MarketTrends 03/31/2023: Finding Balance

Finding Balance

New Two-Month Rate Forecast at HSH.com

March 31, 2023 -- It's Friday, the last day of the month, and so closes a very unsteady March for financial markets. March started with influential yields rising to their highest levels in several months, with the yield on the 10-year Treasury cresting over the 4% mark for the first time since early November. As well, firming inflation re-strengthening labor markets seemed to have the Fed on track for a half-point hike in the federal funds rate at its mid-month meeting, and there were increasing odds for an additional rate hike late in the spring or in the early summer.

The came the exposure of the shakiness and subsequent failure of Silicon Valley Bank, Signature Bank and wobbliness in First Republic that necessitated a market-engineered support package. Fearing the potential for a spreading bank run as nervous and uninsured depositors at other banks started heading for the exits, the Fed created a Bank Term Funding Program so that banks dealing with deposit outflows would be able to leverage their mortgage and Treasury holdings to raise cash. This meant that banks would not have to sell these assets, which, given low yields, would likely have both created losses and required sales of assets in excess of depositor outflow amounts, as they would have needed to be sold at less than face value.

Since those coincident events, and absent any new issues so far, financial markets have calmed a bit. Once slowly shrinking, the Fed's balance sheet has ballooned anew by about $400 billion dollars in short order. With concerns about the mismatch of assets and liabilities on bank books suddenly emerging, the Fed decided at its recent meeting to lift rates by only 25 basis points. At his post-meeting press conference, Fed Chair Powell noted that it was likely that the outcome of the banking stresses would be tighter credit conditions, and that these tighter credit conditions might be considered "as being the equivalent of a rate hike or perhaps more than that." How will this all play out in terms of monetary policy? "We simply don’t know," said Mr. Powell. Reflecting these new uncertainties, the yield on the 10-year Treasury closed March near 3.5%, markedly lower than when the month began.

Future markets pivoted strongly after the meeting, marking down the chances of additional rate increases and marking up the probability the Fed would begin cutting rates later this year. Presently, these speculators place more than a 20% chance of a rate cut as soon as June. The Fed's own forecast still sees at least one more rate hike and no chance of cutting rates in 2023, although cuts are forecast for 2024. Fed members official forecasts call for a sharp slowing in the economy, expecting a GDP rate of 0.4% at the end of 2023, and a considerable increase in unemployment, but so far, slower growth and softer labor conditions are nowhere to be seen.

Want to get MarketTrends as soon as it's published on Friday? Get it via email -- subscribe here!

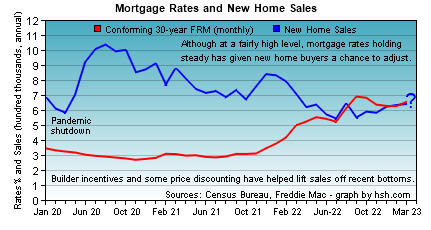

Housing markets have seemed to find at least a little bit of traction -- or at least a little balance of their own -- over the last couple of months, Mortgage rates retreated from 20+ year highs at the end of last year and into this one, and a few more homebuyers found market conditions to be acceptable and jumped in. Since last September, sales of new homes have been climbing nearly steadily, and sales in February were 16.4% higher compared to the end of last summer.

Unlike the existing home market, where inventories of homes for sale are very thin and sellers are usually loath to cut prices, the new home market has over 8 months of supply of homes available to buy at the present rate of sale. In addition, builders have greater leeway in offering a range of concessions to entice buyers, including cutting prices and offering mortgage subsidies to help temper costs. Builder enthusiasm about conditions has recently been on the incline, and construction of new homes has recently been in an uptrend, too.

The existing housing market has also improved a bit over the winter, but of course challenges of availability and affordability still permeate the market. A measure of signed contracts to purchase existing homes -- the National Association of Realtors Pending Home Sales Index -- posted a 0.8% increase in February, a third consecutive gain. Since it can take 45-60 days for a signed contract to become a counted home sale, January's 8.1% increase coupled with February's more modest bump suggests that we'll likely see a continued increase in existing home sales as we move deeper into the spring.

Find these only at HSH.com!

Supporting this assumption is the recent trend for mortgage applications. Despite still-high rates and highly volatile financial markets, applications for mortgage credit actually managed to increase in each of the last four weeks. The Mortgage Bankers Association reported that in the week ending March 24, another 2.9% increase in applications was seen, with requests for purchase-money mortgages moving 2% higher and up about 19.3% over the last four weeks, while applications to refinance existing mortgages surprisingly climbed 4.8% in the latest week, and are up by about 26% compared to where they ended February. To be sure, the overall level of activity is way below where it was a year or even just six months ago, but it's at least a bit encouraging that some consumers will engage the market despite an unfavorable interest rate climate. By now, most homebuyers or refinancers know that the rate they get today isn't likely to be a forever proposition, as opportunities to refinance to lower rates come around on a fairly regular basis.

Providing support to the economy, personal incomes continue to rise, gaining another 0.3% in February. Wage growth also expanded by 0.3% during the month, falling back closer to the recent trend after an outsized bump in January. Proprietor's incomes -- small businesses -- saw their incomes ease by 0.1%, a second consecutive (and like-sized) decline. Incomes from rental properties continues on a upward tear, sporting a 1.4% increase last month, up from a 1.2% gain; four of the last five months have seen 1%+ increases in this segment. Income from assets rose by 0.2% for the month, the softest gain since last September, but direct government transfer payments increased by 0.5%, so some additional tax dollars were spread across the economy. Incomes rose a little more than outgoes did, with personal spending rising by just 0.2% for February, but holding some funds back instead of spending them lifted the national savings rate to 4.6%, the highest it has been in a year.

Price pressures settled back a bit in February, too. Overall inflation as tracked by Personal Consumption Expenditures rose by 0.3% for the month, down again after a more worrisome 0.6% spike in January, and the 12-month run rate for overall PCE inflation eased to 5%, the lowest it has been since September 2021. Deflation in goods prices has helped bring this top-line figure lower and should continue on that path as some large increases over the last 12 months start to fall out of the calculation. However, core PCE is what the Fed cares about (and then core PCE services excluding housing), and this narrower slice also settled back a bit, posting a 0.3% increase last month. Core PCE isn't cooling nearly as quickly as overall costs, since service costs -- largely comprised of labor inputs -- are far stickier. The 4.6% annual rate for core PCE was down a tenth percent from January, matched a recent annualized low water mark and is about equivalent with October 2021 levels. Unfortunately, it is still more than two and a half times the level the Fed hopes to see.

Consumer moods and attitudes continue to stumble along on a rather dismal path. The March measure of Consumer Confidence from the Conference Board saw a modest upturn in confidence, with this barometer rising 0.8 points to a value of 104.2 for the month. Assessments of current conditions were a touch darker, with the 1.9 point decline leaving this component at 151.1 for the month; the expectations portion was a little sunnier, with a 2.6-point rise lifting this portion to 73, and taking back about half of February's 5.6-point fall. Plans to buy cars firmed up a bit, those to buy homes remained flat at a subdued level and expectations for inflation edged higher by a tenth of a percentage point.

See today's mortgage rates every day at HSH.com

Does mortgage history repeat? Usually. Find out what happened last week/month/year with MarketTrends archives!

The Confidence report was a little at odds with the report covering Consumer Sentiment. The University of Michigan poll saw consumer moods darken again, with the overall index posting a 5-point fall to 62.0 for the month. Present conditions -- probably influenced to some degree by the banking issues in the headlines -- dropped 4.4 points to 66.3, while the outlook portion declined by 5.5 points to 59.2 for the month. The overall tenor of the report was pretty dark, and in the statement that accompanied the final update for March, Surveys of Consumers Director Joanne Hsu noted that "our data revealed multiple signs that consumers increasingly expect a recession ahead." Despite this (or perhaps because of it), inflation expectations over the next year retreated sharply, falling from 4.1% in February to 3.6% now, the lowest one-year figure since April 2021. Longer term expectations for prices were unchanged at 2.9% for a fourth consecutive month.

Initial claims for unemployment benefits still aren't signaling much change in the labor market. In the week ending March 25, just 198,000 new applications for assistance were filed across the country, up just a little from a week prior. Since the turn of 2023, just two weeks of the first 13 have seen initial claims exceed the 200,000 mark, so there's little indication that the labor market is loosening. That said, we'll learn a little more about it next week, as the first-week of the month cascade of data includes both an updated Job Openings and Labor Turnover Survey (for February) and the March employment situation report, with fresh data on hiring, wages, participation rates and the unemployment rate. The twin ISM surveys and a few other items will help round out the view of March's economy.

Current Adjustable Rate Mortgage (ARM) Indexes

| Index | For The Week Ending | Year Ago | |

|---|---|---|---|

| Mar 24 | Feb 24 | Mar 25 | |

| 6-Mo. TCM | 4.85% | 5.07% | 0.96% |

| 1-Yr. TCM | 4.46% | 5.06% | 1.55% |

| 3-Yr. TCM | 3.73% | 4.45% | 2.38% |

| 10-Yr. TCM | 3.46% | 3.93% | 2.37% |

| Federal Cost of Funds |

3.139% | 2.998% | 0.791% |

| 30-day SOFR (daily value) | 4.56815% | 4.49249% | 0.04967% |

| Moving Treasury Average (MTA/12-MAT) |

3.466% | 3.138% | 0.219% |

| Freddie Mac 30-yr FRM |

6.42% | 6.65% | 4.42% |

| Historical ARM Index Data | |||

March certainly is ending in a rather different place than where it began. Old sayings used to suggest that it was the weather that would come in "like a lion and go out like a lamb", and that one should "beware the ides of March." The central bank looked to come in strong at the beginning of the month, but by the end of it the expectation is something rather different; meanwhile, in the middle of the month came banking issues and emergency responses. Perhaps there is something to those old myths or adages after all.

No one knows for sure what tomorrow will bring, but it does appear as though stock markets have found some footing of late, and there does seem to be less of a move by investors to get cash out of harm's way over the weekend this Friday than was the case during the last couple. It may be that mortgage rates have found a little balance, at least for the moment, and based upon market activity over the last couple of days, it looks like we may see a little bit of firming in rates over the next few days. If conditions hold, that should translate into a 3-5 basis point increase in the average offered rate for a conforming 30-year fixed-rate mortgage as reported by Freddie Mac next Thursday at noon.

Still-unsettled market conditions make forecasting a fool's errand, but we're always game to give it a go. Have a look at our latest Two-Month Forecast for mortgage rates, which runs from early spring until the unofficial start of summer.

Have you seen our Annual Market Outlook for 2023? We speculate and forecast everything from mortgage rates to home sales and prices and lots in between. Lots to read and consider. Have a look!

For a really long-run outlook, you'll want to check out "Federal Reserve Policy and Mortgage Rate Cycles".

Have you seen HSH in the news lately?

Want to comment on this Market Trends? -- send your feedback, argue with us, or just tell us what you think.

See what's happening at HSH.com -- get the latest news, advice and more! Follow us on Twitter.

For further Information, inquiries, or comment: Keith T. Gumbinger, Vice President

Copyright 2023, HSH® Associates, Financial Publishers. All rights reserved.