February 21, 2025

Preface

It's a tenuous time for long-term bond yields and the mortgage rates that they influence. Inflation has proven to be far more resilient than hoped, helping yields to rise at the end of last year and essentially hold there. While the economy and labor markets remain solid, the possibility for higher price pressures hangs over the financial markets, as investors wait to see the effects of trade and immigration policy changes.

The Fed's preferred measure of prices -- core Personal Consumption Expenditure (PCE) prices -- essentially hit a recent bottom last May at an annualized 2.6%. Since then, core PCE spent three months at 2.7%, then the final three months of 2024 at 2.8%, so there's been no progress on prices for a while now. The picture may brighten a bit as some high-rate months in early 2024 fall out of the calculation, but the most recent incoming data have been less temperate as goods prices have re-firmed and service costs have only gradually leveled. If the imposition of tariffs lifts costs further, any modest retreat in inflation may prove short-lived.

Hopes and expectations that the Fed would remain on a rate-cutting path this year have fallen by the wayside, although there is still a chance for a cut or perhaps two before 2025 comes to an end. But those forecasts of lower policy rates continue to get bumped down the road, and as we write this, there is only about a 50-50 chance that a lower federal funds rate will come as early as June at this point.

Given the backdrop, it doesn't seem as though long-term bond yields and mortgage rates have all that much space to decline, but inflation heating back up again could press them higher.

Recap

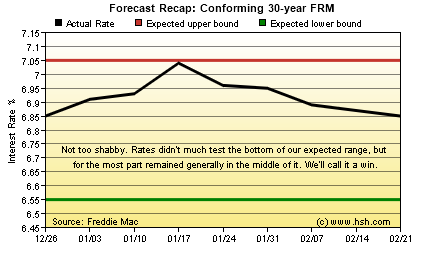

As it turns out, our last forecast was pretty good. We expected that conforming 30-year FRM rates would wander between 6.55% and 7.05%, and the markets mostly provided that. We saw a top rate of 7.04% for the period and a low mark of 6.85%, so there wasn't much by way of testing of the bottom of our expected range. A total of 19 basis points of movement in rates over a nine-week period is about as stable as rates can be. although it would have been better if that stability was at a lower nominal level. We'll call our last forecast "pretty good."

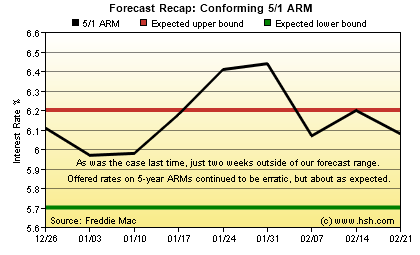

Five-year hybrid ARM rates continue to be erratic, but that's not unexpected when few are being originated or even requested by potential borrowers. Out forecast back in December expected them to run between 5.70% and 6.20%, and in seven of nine weeks they managed to do so, flaring as high as 6.44% but also posting a low-water mark of 5.97%. The forecast was pretty close, but only a little more than three-quarters correct.

Forecast Discussion

After six months of no progress on inflation, it's worth considering if the Fed's aggressive moves to lower rates by a full percentage point between September and December was a case of too much, too soon. It was certainly reasonable enough to expect the Fed to at least start to normalize policy as core PCE inflation retreated from its peak of 5.6% back in 2022, and annualized inflation has fallen by half since then. Still, a few more months with a higher policy rate in place might have been sufficient to crush inflation further.

The Fed still believes its policy is "meaningfully restrictive", per Fed Chair Powell at his last post-FOMC meeting press conference. This means that the Fed still thinks rates are high enough to bring inflation down over time, but Fed members own forecasts don't see the core 2% target coming into range until the end of next year at the earliest. Mr. Powell noted that "we’re going to be focusing on seeing real progress on inflation or, alternatively, some weakness in the labor market before we consider making adjustments [to interest rates]."

But it doesn't appear that investors see things in the same way as does the Fed, at least not bond investors, anyway. Acknowledging that long-term yields rose by about 100 basis points even as the central bank was lowering policy by about the same amount, Mr. Powell said that "it’s more a term premium story," and not directly related to inflation expectations or expectations for policy.

The Fed itself says that "The term premium is defined as the compensation that investors require for bearing the risk that interest rates may change over the life of the bond." It is also reflective of a concern that inflation will erode or eliminate the return from holding a fixed-yield bond for a long period of time. Shorter-term instruments will mature, and new offerings of bills and notes would see their yields increase if inflation should push higher, allowing investors to keep returns in step with price pressures.

As far as expectations for inflation go, they do appear to be somewhat less "well anchored" than they have been. While surveys vary, the New York Fed's poll has seen mid-range expectation (next three years) firm up to 3%, joining both the 1 and 5-year forecast. At last look, consumers polled by the University of Michigan see prices increasing by 4.3% over the next year (up from 2.6% as recently as November) and peg the 5-year outlook at 3.5%, at least a 17-year high. The Conference Board's survey also saw inflation expectations move back up to their highest since July.

To these uncertainties, we add at least one new one: the effects of the imposition of tariffs. While some broad-based ones against Canada and Mexico have been delayed until at least March 4, others such as those on China and for steel and aluminum are kicking in, and will have at least some effect on prices at some point, and not in a positive way.

But if inflation won't cooperate, perhaps a slower economy might help rates to fall? It might, but that doesn't seem to be the base case at the moment. Yes, according to the initial reading of fourth quarter 2024 GDP, there was a deceleration in growth in the end of the year, but only to a still-very-solid 2.25% annual rate. As well, the running rate for first quarter GDP is 2.3%, per the Federal Reserve Bank of Atlanta's GDPNow model, so it looks as though the solid run of growth will continue, at least for the first quarter. That's also much the case with the labor market, which ran quite warm during the fourth quarter, with strong of solid increases in hiring, low layoffs and an unemployment rate that ticked down to 4% over the last three months of the year. How immigration changes will affect the labor market isn't yet clear, but it may presage both slower job growth and faster wage growth. Of course, we'll find out over time.

So if inflation isn't retreating, expectations for future price hikes are firm or rising, there is likely to be meaningful impact on costs from changes in government policy and the economy seems to be performing well, how can long-term rates and mortgage rates find space to decline meaningfully in this climate? The fact is, they probably cannot, absent some significant and unforeseen event.

Forecast

It's not that mortgage rates cannot fall somewhat over the next couple of months, but the conditions that might allow them to meaningfully decline just aren't in alignment at the moment. Even if there is a new downshift in inflation or signals that the labor markets or the broad economy is starting to struggle, it probably doesn't much change the picture for rates until after this forecast period has expired.

The Fed meets again in about four weeks, right in the middle of this forecast. No policy change is expected, but the update to the Summary of Economic Projections and the outlooks it contains do have the power to move the markets. Fed members will certainly have plenty to consider, especially with the likely imposition of new tariff wildcards into the mix just prior to the FOMC meeting.

As far as mortgage rates go, we think that the average offered rate for a conforming 30-year fixed-rate mortgage as reported by Freddie Mac will likely hold in a range between 6.65% and 7.15% over the next nine weeks. For the initial offered rate for 5-year hybrid ARMs reported by the Mortgage Bankers Association, we think that a pair of 5.80% and 6.30% bookends should contain the most popular alternative to a long-term fixed rate mortgage.

This forecast expires on April 25, 2025. It'll be fully a month into the new Major League Baseball season at that point. In between innings, why not stop back and see if this forecast was a strikeout or a home run?

Between now and then, interim forecast updates and market commentary can be seen in our weekly MarketTrends newsletter. You can sign up to get MarketTrends by email, too.