Did you know that millions of Americans are eligible for a mortgage with no down payment? And that nearly all homebuyers can get one with a small down payment of just 3.0% or 3.5%? No? Don't be embarrassed if you didn't know; this can be a confusing topic. Just be ready to learn more -- and then take advantage.

Did you know that millions of Americans are eligible for a mortgage with no down payment? And that nearly all homebuyers can get one with a small down payment of just 3.0% or 3.5%? No? Don't be embarrassed if you didn't know; this can be a confusing topic. Just be ready to learn more -- and then take advantage.

Mortgage with no down payment (or a very low one): everyone's doing it

You might be suspicious about mortgages with a zero or low down payment. Won't those come from dubious, predatory lenders who are out to exploit you? No! Zero-down mortgage programs are backed by the federal government, and most low down payment loans are backed by the FHA, Fannie Mae and Freddie Mac.

Those federal agencies and organizations only guarantee a part of your loan, and you'll still be borrowing from a private company. But the vast majority of mortgage lenders offer some or all of these low-or-zero-down loans -- including famous names and highly reputable ones, so you can pick one you're comfortable with.

Is 3% down too much?

When you're borrowing $100,000, $200,000 or perhaps more, even a 3% down payment can seem an impossible dream. But, for many, it needn't be. Across the country, thousands of programs assist to help homebuyers with their down payment needs -- and often with their closing costs. These offer "down payment assistance programs," aka DPA programs.

How much you get and the form it takes is a zip-code lottery. If you're lucky, you might get nearly all your down payment and closing costs covered by a grant (effectively a gift). In other places, you may be offered a 0% or low-interest loan that's forgiven over several years, providing you continue to live in the home.

If you're "unlucky" (and that's a relative term here), you may get a 0% or low-interest loan to cover your down payment. But it's one you have to repay alongside your normal monthly home loan payments. Even then, the DPA program will take care to ensure you can comfortably afford all your payments.

Related: Guide to Down Payment Assistance Programs in All 50 States

Some low and no-downpayment mortgage rules

There are also mainstream programs that allow you to borrow your down payment. Fannie Mae refers to those down payment loans as "Community Seconds" while Freddie Mac dubs them "Affordable Seconds."

But you have to observe rules. For example, you must usually intend to use the home as your principal residence. And Fannie says:

... funds must be provided by a federal agency, a municipality, county, state or local housing finance agency, nonprofit organization, a regional Federal Home Loan Bank under one of its affordable housing programs, a Native American tribe or its sovereign instrumentality, or an employer.

That last one could be important. Might your employer be willing to help you out?

Confused? You're not alone

You really shouldn't be embarrassed if all this is news to you. You're in good company. In June 2019, Fannie Mae published a study with the title, Consumers Continue to Overestimate Mortgage Requirements.

It found continuing high levels of confusion among wannabe homeowners over what mortgage lenders expect from them. This article is an attempt to help you close what Fannie calls that "knowledge gap." Though "chasm" may be a better word. Because the study found consumers thought they needed:

- A higher credit score than they actually do (on average, 650 as opposed to the 580 they often actually require)

- A higher down payment than is really needed (on average 10%, rather than the 0%, 3.0% or 3.5% commonly available)

- Less existing debt than lenders actually expect (they think lenders want 40% or less of your household income to go back out on existing debts, plus your new mortgage and homeowner expenses. In reality, it can be up to 50%)

Two other knowledge gaps uncovered by the research were depressing. First, only 23% of survey respondents were aware of low- and zero-down-payment options. And, secondly, "don't know" responses were off the charts: 53% for credit scores, 40% for down payments and 61% for debt limits.

Meanwhile, the knowledge gap in some areas is widening instead of closing. When asked how big a down payment lenders "expect" from borrowers, the average answer was 20%! That was actually up from the 15% recorded when the question was last asked in 2015.

What's mortgage insurance all about?

There aren't many downsides to getting a mortgage with no down payment or a low down payment. Your mortgage rate is likely to be close to the average for all loans -- and may even be cheaper with some 0% down payment home loans. It may take you two or three days longer to close. But you can typically get away with a lower credit score. In nearly every respect, these are great mortgages.

However, there's a fly in the ointment with most (but not all) of them. And that fly is called mortgage insurance. This has only one purpose: to protect your lender if you default. But you're the one who has to pay the monthly premiums, which aren't even tax deductible. And those can add up. How much? It depends, which is why HSH.com offers an online PMI calculator that covers mortgage insurance and that can help you model your likely scenario in terms of PMI costs.

We said this particular fly was only in certain ointments. Read on to find details of the different sorts of no and low down payment loans. Assume you have to pay mortgage insurance unless we note otherwise.

Related: Homebuyer assistance programs in all 50 states

Lenders set their own rules

Government-sponsored enterprises Fannie Mae and Freddie Mac set minimum standards for the loans they back. But you're going to be borrowing from a private-sector mortgage lender, and each of those is entitled to impose stricter underwriting standards to make its lending decisions.

These stricter guidelines are called "overlays," and if you're worried about mortgage approval, you'll want to find lenders that adhere to the established guidelines without making it harder for you.

For example, the FHA says that you need a credit score of at least 580 to qualify for a 96.5% mortgage. And the VA sets no minimum credit score at all. But many lenders set their minimum FICO scores for the programs at 620 or even higher.

What then? Well, loads of lenders offer these mortgages. So hunt around for one that's more lenient. Better yet, find out your credit score now and do your best to rebuild it before you apply.

Types of mortgage with no down payment

There are two main types of mortgage with no down payment, and they're both backed by the federal government. What that means is that the government guarantees a part of your loan, reducing the risk your private-sector lender faces in the event you should default. This guarantee lowers the lender's risk, and that lower risk means you can get a competitive rate -- even if you have only a fair credit score -- and still make no down payment.

Of course, if you can manage even a small down payment or if you have a better score, you stand to get an even better deal. As with all mortgage applications, the best rates go to those borrowers with the best credit ratings and strongest applications. But the deals are pretty sweet for everyone who qualifies.

We'll cover in detail both of the no-down-payment home loans next. But they are:

- VA loans -- backed by the United States Department of Veterans Affairs

- USDA loans -- backed by the United States Department of Agriculture

Don't be fooled by the name of that second one. You may be eligible if you're buying a home in just about any rural area and many suburbs. As a bonus, you don't have to be engaged in agriculture in any way to qualify.

You may have noticed the word "main" in "two main types of mortgage with no down payment." That's because there are other, smaller ones. For example, Doctor Home Loan programs offer such deals to physicians and surgeons, and some others do to other health care professionals. Meanwhile, local programs may provide help for other categories of key workers, such as first responders or teachers. Some credit unions even provide zero-down mortgages to their members.

VA loans

VA loans are probably the most famous form of zero-down-payment home loan. As the name implies, they're available only to veterans and current servicemembers. If you're one, and haven't been dishonorably discharged, there's a high chance you qualify. However, there are some VA eligibility rules, mostly about the timing and duration of your service.

With these loans, you have to pay a one-time funding fee upfront. That's currently 2.3% of the loan value for first-time buyers making no down payment, though it might change in the future. The good news is you can add that to your loan instead of coming up with the cash.

VA loan pros and cons

However, there are restrictions on this, as well as any closing costs you want to roll up into the loan. That's because you can't borrow more than 100% of the appraised market value of the home. So you may need to find a motivated seller or a bargain home to be able to have enough space to get all your costs in the loan. It's a myth that those with VA loans can force a seller to cover closing or other costs.

That funding fee is a pain. But it's also a blessing. Because it replaces the monthly mortgage insurance most buyers pay, if they can't raise a 20% down payment. Over time, it may save you a bundle.

The VA doesn't set any minimum thresholds for credit scores. But, as described above, individual lenders may -- and most do.

USDA loans

You could be forgiven for assuming USDA loans are classified Top Secret. Too few people have even heard of them. Too many who have heard of them assume they're only for those engaged in agriculture or at least who want to live in a rural backwater. But neither of those is true.

In fact, many estimate that 97% of the landmass of the United States falls within the territory eligible for a USDA loan. The USDA website has a lookup tool that lets you search for individual addresses that qualify. And it includes plenty of suburbs. Meanwhile, there's no requirement to know one end of a tractor -- or even of a hoe -- from the other.

USDA loans: Eligibility and conditions

There are, however, some personal eligibility hurdles that could trip up many. These loans are intended for moderate- and low-income families and individuals. And you can't earn more than 115% of the median income in your area. How much is that? Again, the USDA website lets you check income limits county by county. The more people in your household, the more you can earn and still be eligible.

If you get one of these, you'll have to pay a fee of 1% of your loan amount as part of your closing costs. This fee can be added to your mortgage balance, providing you don't borrow in total more than 100% of the home's appraised market value.

Unlike with a VA loan, you still have to pay mortgage insurance each month. But it's at a lower rate than with many low down payment mortgages. Currently, that rate is 0.35% of the loan balance per year -- broken down into 12 equal monthly installments.

Low down payment mortgages

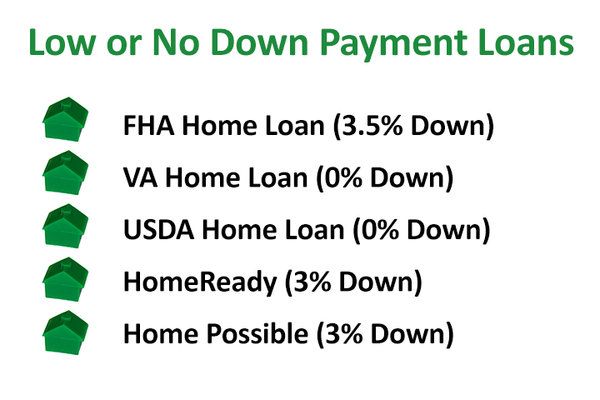

There are four main types of mortgages with low down payments:

- FHA loans -- Backed by the Federal Housing Administration, these are available with down payments as low as 3.5%

- Traditional 3% down mortgages from Fannie Mae or Freddie Mac, available to first-time buyers only

- HomeReady from Fannie Mae or Home Possible from Freddie Mac -- As little as 3.0% down for low- and moderate-income buyers

- "Piggyback" loan -- You put down 10% of your purchase price out of your own money. You borrow another 10% as a home-equity loan or line of credit (second mortgage). Your primary mortgage is only 80%, meaning it ducks mortgage insurance

There may be other types, including proprietary ones. Most turn out to be based on one of the above four, once you lift the hood.

Let's now look at each of those in turn.

FHA loans -- advantages

There's a lot to like about FHA loans. Here are some of their upsides:

- A down payment as low as 3.5% -- Though you're likely to get a lower mortgage rate the more you put down

- A minimum credit score of 580 if you're putting down 3.5% -- and, in theory, your score can be as low as 500 if your down payment is 10%. But don't forget individual lenders are free to set their own minimums. And you may have to hunt around to find one willing to go so low. It's easier to borrow if your credit score is 620 or higher

- A mortgage rate that's comparable with those for conventional loans* -- Looking back through Ellie Mae's origination reports, they're rarely far apart on average. Indeed, sometimes, FHA rates are virtually the same as those for conventional loans

*Conventional loans are mortgages that aren't guaranteed by the government. They're often backed by Freddie Mac or Fannie Mae.

Related: FHA Loan Requirements

FHA loan drawbacks

You've already read about the significant drawback that FHA loans bring. It's mortgage insurance.

You have to pay 1.75% of the loan amount as an upfront premium. Luckily, that can be rolled up within your new loan so you may not need to find that much additional cash. Which is just as well. Because 1.75% may not sound much, but it would be $3,500 if you were borrowing $200,000.

But that's not the end of it, because you typically have to continue to pay mortgage insurance premiums each month -- for as long as you have the loan. The annual premium will be in a range of 0.15% to 0.75%, depending on the size of the loan, how big your down payment is and your new mortgage's original term. If your down payment is 3.5% and you want a 30-year mortgage, expect to pay the maximum amount.

For borrowers looking for loan amounts below $806,500 -- which fits our example above, you'd be looking at 0.55% of $200,000 -- or $1,076 during the first year (monthly costs decline incrementally as your loan balance declines). You'd actually pay that monthly: $89.65 each month. No wonder many borrowers use FHA loans to get themselves on the homeownership ladder and then refinance to a loan without mortgage insurance as soon as their mortgage balances hit 80% of the market value of their home.

Types of FHA loans

Most borrowers go for the plain vanilla flavor of FHA loan described above. But there are three variations that can help buyers in particular circumstances:

- 203(k) loan -- This can be useful if you want to buy a fixer-upper. Because you can borrow the home's purchase price and your renovation budget with one single loan

- Limited 203(k) -- Like the first, but easier if your renovation budget is $35,000 or less. It features less burdensome paperwork because the construction is minimal

- Energy-efficient mortgage (EEM) -- This is for green (in the environmental sense) borrowers who want to buy either a home that is already EnergyStar certified or one that they plan to make energy efficient. You can borrow a bigger proportion of the home's value and your lender should count your estimated savings on energy costs as if those were extra dollars of income

Related: Buying a Fixer-Upper? Here's the Mortgage to Do It

Fannie and Freddie with 3% down

Fannie Mae and Freddie Mac were created by Congress and are not completely private, nor are they completely government agencies. They are GSEs, or government sponsored enterprises. Their role is "to provide liquidity, stability and affordability to the mortgage market," according to the Federal Housing Finance Agency.

Fannie and Freddie both offer traditional 3% down mortgages (sometimes called "Conventional 97s)" that are only available to first-time homebuyers, defined as someone who hasn't owned a home in the past three years. These don't have income limits or location restrictions.

Beyond this, the GSE's position at arms length from the government allows them to be a bit more creative and helpful than many directly controlled agencies. Fannie's HomeReady and Freddie's Home Possible offerings are examples of this.

HomeReady and Home Possible loans have some common characteristics:

- HR and HP programs aren't limited to first-time borrowers, but there are income or geographic limits

- They're intended for borrowers with low or moderate incomes -- those eligible have gross incomes no higher than 80% of the area's median income. Not sure about your eligibility? Use the Fannie Mae lookup tool or Freddie Mac tool. to see income limits in your area

- These require only a 3% down payment -- this can come from your savings, a recognized down payment assistance program or your employer

- You can typically cancel your mortgage insurance as soon as your mortgage balance reaches 80% of your home's market value

- The programs accept repeat buyers as well as first-time ones, though you may need a higher down payment (5%) if you're already a homeowner

- Loans are available up to standard conforming loan limits

- You must complete a homebuyer education course to qualify for either of these

- These don't have additional risk-based rate or fee increases, and are eligible for reduced-rate Private Mortgage Insurance

But they also have some differences, which are coming up next. Remember, you'll still be borrowing from a mainstream, private-sector, mortgage lender. Fannie and Freddie may ultimately buy or sell your mortgage and their rules only mean that a lender can be sure your loan is eligible for purchase. All lenders are free to set their own requirements for borrowers and homes.

Related: Compare FHA, Conventional 97, HomeReady and HomePossible costs side-by-side

Fannie's HomeReady

HomeReady from Fannie Mae may see you get away with a credit score as low as 620. However, Fannie acknowledges you'll likely get a better deal if yours is 680 or higher.

If your new home has a rental unit or you rent out a room to a boarder, you may be able to count the money you're going to get from those as part of your income when applying. But you'll have to list it separately, and the lender may wish to check that your expectations are realistic. For more info on this, read "Using boarder income to qualify for a mortgage".

There's no minimum requirement for the amount of your own cash you contribute to your down payment. Besides your employer and any down payment assistance you receive, you can use gifts from family members. However, those will need to be properly documented. If you're really lucky, you might even be able to buy without using a cent of your own savings.

Freddie's Home Possible

The standard Home Possible credit score is 680 or better. Yes, you may be approved if yours is lower. But it's likely going to cost you.

Freddie specifically mentions sweat equity as an acceptable source of down payment funds. It explains what it means by that:

Borrowers can use their construction skills, instead of cash, to cover some or all of their down payment and closing costs without dipping into personal funds. This increases the pool of mortgage-ready customers for lenders. Sweat equity refers to materials provided or labor completed by a borrower prior to closing on a property. The value of the labor they provide and the money they spend on materials to renovate the home is considered the equivalent to personal funds.

Piggyback loans

We've already established that mortgage insurance (MI) is often despised by those who have to pay it. It's expensive and its only benefit goes to the lender rather than the homeowner.

But, unless you get a VA or USDA loan, it's close to inevitable for those who can't make a down payment of at least 20% of the purchase price. Looked at the other way, to avoid paying MI, your main mortgage must be (have a "loan-to-value ratio" (LTV) of) 80% or less of the purchase price. For many first-time buyers, that's a near-impossible dream.

Piggyback loans provide a way to avoid MI, even if you haven't saved a 20% down payment.

How piggyback loans work

With a piggyback loan, your main mortgage covers only 80% of the purchase price. So no MI is due on that, but you make up the difference with a second loan and (usually) a down payment.

Piggy-back mortgage combinations get their names from the percentage of the purchase prices that you finance with the second mortgage. So if you put 5% down, your loan is an 80-15-5. Your first mortgage is 80%, your second is 15%, and your down payment is 5%. You can also find 80-10-10 loans with you putting 10% down.

You can get your secondary financing from a mortgage lender or sometimes the home seller.

Types of piggyback loans

Most people at the moment want their main mortgage to be a 30-year, fixed-rate one, but you may be able to choose from a variety of adjustable rate mortgages (ARMs) with lower rates that are fixed for up to ten years.

Your "purchase money second" mortgage is likely to be a fixed-rate loan, also secured by your home. That means you could face foreclosure if you don't repay it as agreed.

Expect to have to pay your loan off in 10, 15 or 20 years. The shorter term helps you gain home equity faster and pay less interest over the life of the loan. But it does increase the monthly payment.

Your lender(s) should take care to ensure you can comfortably afford both loans.

Dangers of piggyback loans

You should be able to find a piggyback loan that meets your needs. But you need to select yours with care. In particular, watch out for:

- Early termination fees -- aka the prepayment penalty. You don't want to be hit by hefty fees if you later want to sell the home or refinance your mortgage

- Balloon payments -- with these, your monthly payment is based on a smaller amount than the entire balance. So, some or all the principal balance only becomes due at the end of the term. Your monthly payments may be mostly or only interest, and at the end, you may owe a sizable lump sum.

By all means, take advice from professionals. But, in the end, it's your job to make sure you understand what you're committing to. And that you are equipped to deal with any consequences.

Related: Q & A (Piggyback Mortgages)

When low- or zero-down payments are a good idea...

Suppose you live in an area where home prices are rising quickly. You might easily find that those price increases are outstripping your ability to save for a 20% down payment or even just 5 percent. It may well be that paying for mortgage insurance or taking a piggyback loan makes sound financial sense.

You can absolutely work out whether this applies to you; it's basic math. Use HSH.com's mortgage calculator to see what you're going to pay for your mortgage if you buy now with no down payment or a low down payment one. As well, track home prices in your area to see how much might be losing by not being a homeowner. In many cases, your choice will be a no-brainer.

And, if you're eligible for a VA loan, that choice may be even easier. With no continuing mortgage insurance premiums, you're very likely to find you could be better off owning rather than renting.

...and when they're not

Right now, across most of the country, home prices are uneven but mostly still rising. But there are pockets where they're shooting up. And others where they're stagnant or even falling.

At times and in some markets, it's significantly cheaper to rent than buy. So you might pay less by renting until you have a 20% down payment in hand, and as a bonus you'll be able to skip paying PMI when you buy.

In those circumstances, where home values are moving down or holding steady, there's less urgency for you to get on the homeownership ladder. You may legitimately prefer to wait until you've saved enough for a 20% down payment, and indeed, falling home prices should make the day when you reach your target come sooner.

Risk and reward

Of course, both pulling the trigger on buying or holding off come with risks, because both rely on assumptions. You assume that home prices will continue on the trend you're seeing locally, and you're assuming mortgage rates won't suddenly leap higher or tumble.

However, that's just a part of life. We all have to make numerous assumptions every day: that the bus will stop at the crossing, that we won't win the lottery, that our job is safe. All we can do with something as big as a mortgage is weigh our choices, recognize our risks and proceed with a decision we make in good faith.

Compare mortgage programs and rates now

This article was revised and updated by Keith Gumbinger.