Taxes for homeowners have undergone some serious revisions over the last few years. The most recent major overhaul -- the 2017 Tax Cuts and Jobs Act (TCJA) -- altered the way many homeowners file their taxes, mostly because of substantial increases in the Standard Deduction. Here is what you need to know about 2024 tax breaks for homeowners before filing your return.

Taxes for homeowners have undergone some serious revisions over the last few years. The most recent major overhaul -- the 2017 Tax Cuts and Jobs Act (TCJA) -- altered the way many homeowners file their taxes, mostly because of substantial increases in the Standard Deduction. Here is what you need to know about 2024 tax breaks for homeowners before filing your return.

What Can Homeowners Deduct on 2024 Tax Returns?

The most recent tax code overhaul did not eliminate deductions for homeowners. It did, however, limit them for some and make them irrelevant for others.

Mortgage interest deduction

For mortgages closed on or before December 15, 2017, joint filers can deduct mortgage interest on the first $1 million of debt. For loans closed on December 16, 2017 or later, joint filers can deduct mortgage interest on the first $750,000 of mortgage debt. This amount is halved for single filers or married taxpayers filing separately.

Your mortgage lender should send you a Form 1098 indicating the amount of interest that you paid in 2024. If you are filing an itemized return, you would deduct your interest on a 1040 Schedule A.

Related: How does a refinance affect your taxes?

Home equity loan or HELOC interest deduction

Prior to the 2017 TCJA, homeowners could deduct interest on up to $100,000 of home equity debt, and it did not matter how the funds were used. Today, you can no longer deduct interest for home equity debt - regardless of when that debt was incurred - unless the loan proceeds are used to "buy, build, or substantially improve a qualified home", per the IRS.

Purchase money second mortgage interest qualifies for the deduction. So does the interest on a home equity loan to renovate your house. But borrowing to make repairs does not qualify. Note also that just because you were able to deduct interest on a home equity loan taken out before the passage of TCJA does not mean you can continue to take the deduction. You can continue to deduct your interest only if the debt qualifies under the Act today.

Related: How to Lower Your Property Taxes

Property tax deduction

If you file and itemized tax return, you can deduct your home property taxes - to a point. Your tax deduction maxes out at $10,000 for all state and local taxes (SALT), including property taxes. So if your state income or sales tax deduction plus your property tax exceeds $10,000, you won't be able to deduct everything you paid. And if you're married filing separately, this limit drops to just $5,000.

Home office deduction

Worked from home a lot in 2024? Regardless of whether you own or rent, if your home office qualifies, you can deduct the cost of maintaining it on a Schedule C, E or F. You can choose one of two ways to calculate your deduction. The easiest way is to simply deduct $5 per square foot for up to 300 square feet of dedicated office space. ("Dedicated" means you only use this space for work.) If your office is 200 square feet, your deduction is $1,000.

However, you might get a bigger deduction by adding up the actual expenses of maintaining that space. Normally, you calculate the total household maintenance, including utilities, cleaning, repairs, mortgage interest (if not deducted on Schedule A), and then divide by the percentage of your home's square footage allocated to your office. So if your entire 2,000 square foot home maintenance costs $20,000 per year, and your office is 400 square feet (20% of the home), you would deduct $4,000 (20% of $20,000). You'd also add expenses specific to the home office, for instance, installing office equipment.

The IRS covers the home office deduction in this Simplified Option for Home Office Deduction article on the IRS website.

Rental deduction

If you rent out part of your home, either to a long-term tenant or through a service like Airbnb, you can deduct the expenses related to that enterprise, up to the amount of rental income.

You can fully-deduct amounts related to just the room(s) you rent - repainting the interior of the room, for example, or a television for that room only. You can also deduct depreciation for the room(s) that you rent.

For costs related to the entire home, you can partially deduct them. Such expenses may include

- home mortgage interest

- repainting the entire home exterior or replacing the roof

- homeowner's insurance

- utilities - gas, electricity, heating oil

- gardening and/or housekeeping services for the entire home

- trash removal

- snow removal

- home security system or service

- condominium association fees

Note that unlike full-time real estate investors who actively manage their rentals, you can't deduct losses that exceed the amount of your rental income.

Publication 527 is where you'll find everything you need to know about taxes and residential rentals.

What about mortgage insurance?

Mortgage insurance (PMI) is NOT deductible for tax year 2024, nor are any mortgage insurance premiums (MIP) you pay on an FHA-backed loan. This is per IRS Publication 936.

The tax deduction for PMI premiums (or Mortgage Insurance Premiums (MIP) for FHA-backed loans) is not part of the tax code, but since the financial crisis has generally been authorized by Congress as parts of other bills and "extended" to cover the most recent tax year. There is no way to know when or if deductibility for MI premiums will be extended again.

The official IRS code covering the deductibility of mortgage interest (which, if again deductible, will includes PMI premiums) can be seen in Publication 936. Since the deductibility of PMI and MIP could be reauthorized at any time, it's a good idea to check both the IRS website and Publication 936 before you file your returns.

If you should file an itemized return on Schedule A, and mortgage insurance premiums later become retroactively deductible for tax year 2024 you might consider filing an amended tax return, to capture the MI deduction for 2024, if you previously itemized your deductions and it's worth it in your situation.

You can find the amount of mortgage insurance premiums you paid on the Form 1098 that your lender or servicer sends to you each year. It is listed in box 5, separate from the mortgage interest you paid (box 1).

Mortgage closing costs

Can you deduct closing costs when you refinance or buy a home? Yes, and no. Here are fully-deductible costs that you can deduct when you close on a home purchase:

- Sales taxes at closing

- Real estate taxes

- Mortgage interest paid at closing

- Loan origination fees calculated as a percentage of the loan amount (points)

You can deduct points paid on a home improvement loan to improve your home in the year that you close on the loan. But you must prorate over time any points paid to refinance.

Here is how prorating your closing cost deduction works: You deduct these costs over the life of the loan in equal amounts each year. If you pay $3,000 in refinance points for a 30-year mortgage, you get to deduct $100 per year ($3000 / 30). If you pay off the loan early, you can deduct the remaining points. After ten years in this example, you'd deduct the remaining $2,000 if you refinanced or sold your home.

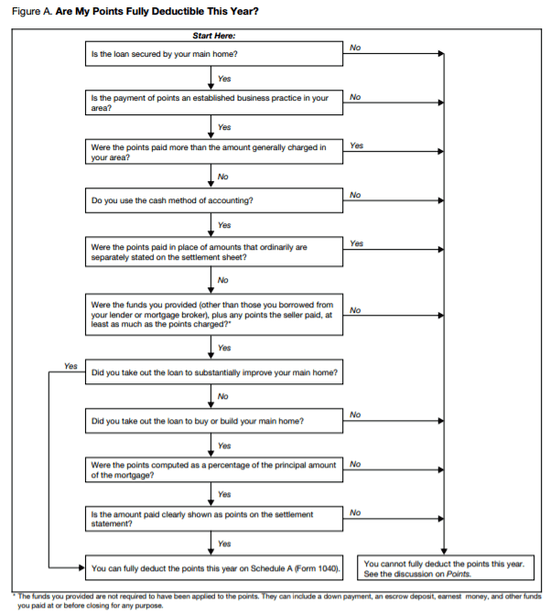

The IRS created this fun chart you can look at to see when your points are deductible.

See IRS Publication 530, "Tax Information for Homeowners" and look for "Settlement or closing costs" for more details.

Related: What's the Point of Paying Points?

Energy Tax Credits

Made any energy-saving improvements to your home? They may qualify for some additional savings come tax time. Provided the upgrades can be found on Energy.gov's list of tax-deductible energy improvements, you might be able to deduct up to 30% of the cost of adding them to your home. Whether an upgrade is deductible or available as a credit, you'll need to fill out IRS Form 5695, following IRS instructions, and include it when filing your tax return. Make sure you have and keep all relevant product and services receipts for your records and in case of a later audit.

For an overview, see Home energy tax credits at the IRS website.

Accidental Loss

Homeowners who've had the misfortune of going through a sudden, unexpected or unusual event such property damage as a result of a hurricane or wildfire may be able to deduct a portion of the loss. The IRS says "A casualty loss can result from the damage, destruction, or loss of your property from any sudden, unexpected, or unusual event such as a flood, hurricane, tornado, fire, earthquake, or volcanic eruption.

IRS Tax Topic 515 covers the basics. In general, if the loss is caused by a federally declared disaster, you may deduct personal casualty losses relating to your home, household items, and vehicles on your federal income tax return. If not a federally-declared disaster, a deduction is generally not available for personal casualty losses, at least for tax years 2018 through 2025.

The IRS provides an example.

As a result of a storm in 2024, a tree fell on your house, and you suffered $5,000 in damage. The President didn't declare the storm a federally declared disaster. You filed a claim with your insurance company and reasonably expected the entire amount of the claim to be covered by your insurance company. However, your insurance company paid you only $3,000 and determined it didn't owe you the remaining $2,000 from your claim. Because the $2,000 isn't a federal casualty loss, it isn't deductible.

Federal casualty losses, disaster losses and qualified disaster losses are three categories of casualty losses that refer to federally declared disasters. The requirements for each loss vary. For more information, see Publication 547, Casualties, Disasters, and Thefts.

Related: Do you have to pay my mortgage if your home is destroyed?

What if I Sold My Home in 2024?

If you lived in your home for at least two of the last five years, you can exclude up to $500,000 ($250,000 if single or married filing separately) of the gain on your home sale from income taxes.

"Gain on sale" for tax purposes equals the net sales proceeds (after closing costs) minus the cost of acquiring and improving the property (known as "basis"). Note than some of the closing costs you can't deduct when you purchase a home are considered acquisition costs and reduce your taxable amount when you sell the property. Your net proceeds minus your basis equals your gain. If that exceeds your exclusion ($500,000 or $250,000), you'll report your taxable profits on Form 1040 Schedule D.

For more details, IRS Publication 523 covers capital gains due from the sale of your home.

Related: How to Sell a Home at Auction

Check Your Standard Deduction

You can only deduct mortgage interest, property taxes and home equity interest if you itemize your deductions. The home office deduction applies almost exclusively to self-employed taxpayers, as you can no longer deduct unreimbursed business expenses.

When should you itemize your tax deductions? Only when your total itemized deductions exceed the standard deduction. Itemized deductions include mortgage interest and property taxes, but also state income tax or sales tax, charitable contributions, and qualifying medical expenses.

Note that many who itemized before the 2017 Tax Cut and Jobs Act no longer do. That is because the standard deduction was increased substantially. Here are the thresholds for 2024:

- $29,200 for married couples filing jointly

- $21,900 for heads of household

- $14,600 for single filers or married filers filing jointly.

The standard deduction for each of these filing classes is increased by $1,950 for single homeowners aged 65 or older, or for head of household filers. Married filers can claim an additional $1,550 per qualified filer.

Note that if you are married and filing jointly, one of you can't take the standard deduction while the other itemizes. You have to both use the same method. In addition, some deductions that you might have taken in the past are no longer allowed. These include: tuition and fees, unreimbursed employee expenses, tax preparation costs and casualty and theft losses.

Does Buying a Home Help at Tax Time?

For many, the answer is… maybe. Assuming that you could shelter little-to-no income by itemizing unless you owned a mortgaged property, your mortgage and property taxes would make up the bulk of your Schedule A deductions. Singles with lower standard deductions and more expensive homes would be more likely to break the standard deduction threshold. But remember that $750,000 limit? And that $10,000 maximum for state and local taxes? And the fact that single filers have their deductions slashed by 50%?

You don't just have a floor; you also have a ceiling.

So to determine if buying a home would help you at tax time, you must consider:

- The interest deduction you'd receive. You can estimate this with an amortization calculator or ask a loan officer

- Your deductible state income tax (or sales tax - check your last year of returns to see how much you paid) plus your estimated property tax (ask a lender or real estate agent)

- Your filing status - remember that if you are single or married and filing separately, your maximum deductible mortgage amount is halved. So is your state and local tax deduction

In general, single filers have less trouble hitting the point at which the mortgage deduction lowers their taxable income because their standard deduction is lower. But higher-earning singles with expensive homes benefit less than joint filers, whose limits are twice as high. It's interesting that under these simplified tax brackets, filing and planning continue to be complicated.

In case you're wondering, no, premiums for homeowner's insurance aren't deductible. But it is one of the housing issues we think that Congress should consider.

And, of course, when dealing with tax matters, it's always a good idea to consult with a professional.

Considering refinancing? Compare mortgage options now

This article was revised by Keith Gumbinger.