June 27, 2025

Preface

Watching, waiting and hoping for a positive outcome. This could describe a lot of situations at the moment, and is certainly applicable when it comes to the interest rate outlook. With considerable "blanket" tariffs in place and highly-specific deals still being negotiated, it's hard to know exactly what the effects on inflation and the broader economy will be, or when any effects can be expected to show. So, we watch and wait.

Ultimately, these new or increased levies must be paid; what's uncertain is who will bear the brunt of them. Will none, most, some or even all increases in costs be borne by supply chains? How much of them makes it into the final costs consumers pay? Is any effect on inflation revealed as a short-term, one-time bump in costs, or something more protracted? The potential outcomes are as varied as are the inputs. The 90-day "pause" on wide-ranging reciprocal tariffs technically expires in the middle of this forecast period on July 9, and what comes after that is anyone's guess. Ours is that an extension of the "pause" is announced.

The backdrop to this is also uncertain. The fractious budget-making process for the U.S. is ongoing, as are yawning fiscal deficits, and there's another debt ceiling deadline rapidly approaching. Record U.S. bond issuance is all but guaranteed to continue, and there's no way to know if demand for Treasury debt will be met with commensurate demand from investors. In this regard, Moody's lowering of the U.S. credit rating this spring is also playing a role.

We'd be remiss if we didn't note the fresh upheaval in the middle east as well, and the military actions of both Israel and the U.S. in Iran. How this may play into the economic and inflation picture over the coming weeks is yet unclear. Time was when upset in the world saw U.S. interest rates head lower in flight-to-safety or -quality buys by investors, but that seems to be somewhat less the case of late. The situation in the middle east remains "fluid", as the phrase goes.

Many variables in play make it hard to have a high degree of confidence in any forecast, but we'll do our best to make a compelling case for this one.

Recap

The last forecast period had some unknowns heading into it, too, as the announcement of the imposition of significant tariffs took place, fomenting tremendous financial market turbulence. Shortly thereafter, a 90-day "pause" on reciprocal tariffs was announced, calming things down a bit.

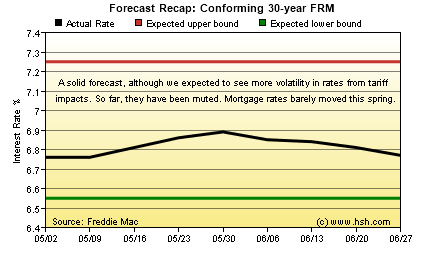

During the period, we expected to see the average offered rate for conforming 30-year fixed-rate mortgage as reported by Freddie Mac to run in a range between 6.55% and 7.25%, as we anticipated a period of fair volatility. Instead, we saw a period of relative stability, and the average rate only ranged from 6.76% to 6.89%, about as unchanged as any market-based interest rate can be over a couple of month stretch of time. As such, we hit our forecast expectations, but never tested anything close to the top or bottom of them. We'll call it a victory, although our expected range was a set little wide to accommodate volatility that never showed.

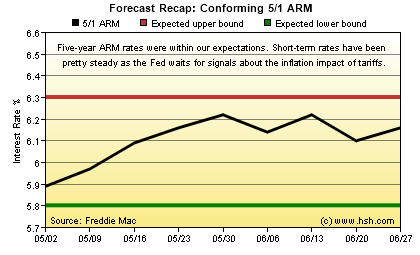

For hybrid 5-year ARMs, the short-term interest rates which govern their movements are highly influenced by what the Fed does, and amid great uncertainty during the period, the Fed did nothing. As such, only market-based influences moved rates, and that very little. Back in April, we thought that the initial fixed interest rate for these alternative products would hold in a range between 5.80% and 6.30%, and were pleased to see them stop short of both bookends, hitting 5.89% on the low end and 6.22% on the top. All in all, an outcome that conformed well to our expectations.

Forecast Discussion

The next couple of months are likely to be at least as uncertain as the last couple; that span resulted in fairly stagnant period for interest rates. But will it be a summer of stasis for mortgage rates? Certainly, that's a possibility. As was the case for the last nine-week period, action by the Fed seems unlikely; they next meet in late July. Between now and then, it's probably equally possible that we'll start to see some inflation from tariffs begin to be reflected in the hard data as it is that labor conditions will slacken somewhat further. However, unless there is a marked downturn in hiring or a sizeable increase in unemployment, the Fed isn't likely to make a change any earlier than September.

We wrote the last forecast before the GDP report for the first quarter was released, and it came in mildly negative, thanks to a spate of imports in the early months of the year in an attempt to front-run expected tariffs. Those effects have waned, and outside of them, growth appears to have simply burbled along. The Fed's most recent forecast for growth pegs it at just 1.4% rate for the year, down from a 1.7% estimate in March, but the current running rate for the second quarter is believed to be somewhere between 1.91% and 3.4%, with just a little more than a month of data yet to come. Slower growth should help provide some offset to any tariff inflation that may come, but how much is an open question.

Slow-but-still-positive growth accompanied by somewhat higher inflation makes Fed action unlikely, and also doesn't provide market-based interest rates much reason to move significantly lower or higher, either. That mortgage rates are stable isn't a bad thing, but that they are stable at elevated level certainly isn't a good thing, at least for potential homebuyers and those looking to refinance. At present, the elevated level for rates has at least as much to do with the supply of bonds as it does current and expected inflation, and getting longer-term interest rates to meaningfully decline may require both a deceleration in inflation and at least some fiscal prudence. Neither of those can be expected to be seen anytime very soon.

When they eventually do show, if price pressures from tariffs appear to be fleeting -- a short-lived bump for a couple of months or perhaps a bit longer -- the Fed would have some space to trim interest rates slightly later this year. But until tariff-driven inflation starts to show, there's no way to know what size or form it will take, let alone how long it might hang around.

So what might move interest rates over the summer? At least from an economic perspective, the path ahead will most likely see sluggish growth (perhaps increasingly so), continued modest labor market softening and inflation stepping a bit higher. The first two factors would help promote slightly lower long-term rates, while the third would counter any downward pressure to a degree. Non-economically, and given the U.S.'s direct involvement, the situation in the middle east may become a greater influence on financial markets over the coming months. The prospects for retaliation or additional military action can't be discounted as yet, and such actions carry unknowable consequences and outcomes. Even absent additional conflict, it is possible that saber-rattling and fresh bellicosity fosters a bit of a flight-to-safety buy of Treasurys at times, helping long-term rates to decline a bit.

In all, three concerns that may promote somewhat lower rates and one that may promote higher rates. This is hardly a recipe for a significant move in either direction, but does suggest that more relative stability for interest rates is most likely to be seen, although perhaps with a bias toward slightly lower rates as we go along.

Forecast

The next nine weeks seem likely to feature a lot of watching and waiting. Inflation may firm somewhat and growth and labor conditions ease a bit. To us, all that suggests is that mortgage rates will continue to be mostly in a holding pattern, and that the wider-than-normal range we used for the last forecast can be cautiously tightened up somewhat. Over the next nine-week period, we think that the average offered rate for a conforming 30-year fixed-rate mortgage as reported by Freddie Mac will hold in a range between 6.63% and 7.03%. As far as the initial interest rate for a hybrid 5-year ARM, we think that the previous pair of fences is appropriate for a third consecutive forecast period, and that the Mortgage Bankers Association will report that their survey sees 5-year ARMs rates run between 5.80% and 6.30% again.

This forecast expires on August 29, 2025. The school year will have either already kicked in, or will be just about to in most areas. While settling into the new routine, why not stop back in and see if we earned a star or a dunce cap with this forecast?

Between now and then, interim forecast updates and market commentary can be seen in our weekly MarketTrends newsletter. You can sign up to get MarketTrends by email, too.