The Federal Reserve took no action today, holding the federal funds rate steady at range of 4.25% to 4.5% While the Fed's quasi-official outlook is still that rates are likely to be lowered in 2025, the cadence of rate cuts is likely to be irregular and the size of any cuts small.

Since the last FOMC meeting in mid-March, financial markets in the U.S. and around the world had a period of upheaval, all sparked by the announcement and imposition of new tariff structures on U.S. trading partners. The early April announcement saw significant sell-offs and rallies in stock markets and a spike in long-term bond yields. Likely as an attempt to quell the disruption, most but not all announced tariffs were subsequently reduced to a flat figure for the next 90 days, with negotiations among partners occurring during that period. Information regarding any outcomes from these discussions hasn't exactly made headlines, although China retaliated with new levies of their own. Since then, the U.S. and China have exempted certain items from the massive cost increases.

In an speech on the economic outlook at the Economic Club of Chicago in mid-April, Fed Chair Powell spoke quite plainly. "The new Administration is in the process of implementing substantial policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. Those policies are still evolving, and their effects on the economy remain highly uncertain." He continued: "The level of the tariff increases announced so far is significantly larger than anticipated. The same is likely to be true of the economic effects, which will include higher inflation and slower growth" [emphasis ours]. It is somewhat unusual to hear a Fed Chair describe something in an such absolute manner; more typically, you would hear "may", "are likely to" or similar language.

This observation wasn't well received by the President, who taunted the Fed Chair, making unflattering comments and threatening to fire him. Financial markets took this rhetoric as something that might undermine the Fed's independence, and stocks spent several days in selling mode while bond yields spiked higher again. The new upheaval in markets saw the President step back, ultimately saying he had "no intention" of firing Fed Chair Jerome Powell. This relaxed wary investors to some degree, and markets calmed, but this calm feel tenuous at best.

Upheaval in the financial markets and concerns about inflation have significantly darkened consumer and business outlooks and moods, but at least so far, hard data showing deleterious impact have been scant. This is true even with a negative first quarter reading on GDP growth (-0.28%), as the decline related almost solely to a huge surge in imports in advance of expected cost increases. Other important indicators such as labor market conditions and consumption have still been positive, but concerns remain that the effects of upheaval won't start to be seen until we are deeper into the year.

It is a challenging time for the Fed. If the recent cooling in inflation reverses course due to the imposition of higher levies (amount still as yet unknown), it really cannot cut interest rates to support a slowing economy. If the economic impact of higher costs doesn't slow growth all that much (due to offsets that might include, for example, lower energy costs) fair growth at a time of rising costs might instead call for higher interest rates... but the Fed would be reluctant to increase rates, which would generally tend to cause labor conditions to worsen. Thankfully, it doesn't appear as if the Fed is in a "rock or a hard place" just yet, but the risk that they will find themselves there at some point seems to be increasing.

Fed Chair Powell's prepared remarks underscored this point: "The risks of higher unemployment and higher inflation appear to have risen, and we believe that the current stance of monetary policy leaves us well positioned to respond in a timely way to potential economic developments."

In a reply to question at the post-meeting press conference, Chair Powell noted that the stance of policy is still "modestly or moderately restrictive." This suggests that it is likely closer to real-time neutral than not, given the present level of inflation and observable economic fundamentals. The Fed does not actually know where "neutral" for policy rates actually lies, and with quite a bit of policy restriction now removed, the central bank is likely to be considerably more measured in how it adjusts rates in the coming year,

The so-called "real" federal funds rate (the difference between the core PCE inflation rate and the nominal federal funds rate) is still positive, given that core PCE inflation recently posted a 2.6% annual rate and the funds rate is approximately 4.33%. However, it is by no means clear if the current level for policy is providing or will provide enough drag as to allow inflation to retreat to target levels anytime very soon. In the March Summary of Economic Projections (SEP) the forecast for core PCE was increased, so little or no additional progress on inflation is expected this year.

What the Fed said about current risks The statement that closed the meeting didn't set off any alarms, simply saying that "Although swings in net exports have affected the data, recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated."

While expectations for future cuts in rates remain, the Fed gave no specific indication that policy will be changed again soon or on any regular basis. "The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen," read the statement. March's statement said that "Uncertainty around the economic outlook has increased," and the prior two meetings noted that risks to achieving its employment and inflation goals are roughly in balance." As such, concerns among members regarding the outlook have been rising for months, but so far, there's not enough hard evidence to require action.

The last SEP indicated that members expected 1 to 2 cuts in rates to happen before 2025 was out, but these forecasts came weeks before the tariff announcements occurred and were based on assumptions and presumptions of lower-than-announced levies. The 90-day window from the early April announcement means anything remotely close to better clarity as to how costs will change won't come until after the next SEP, which will happen with the June meeting. It may very well be that members will no longer expect to trim rates until next year at the earliest.

The path back to "neutral"

Still early in a rate-cutting cycle that may now take more than two years to complete, it's now clear that the Fed will likely be adjusting policy at a more measured pace. As it is a moving target and said to not be directly observable, it's not exactly clear where the "neutral" federal funds rate actually is at any given time. Presently, Fed members seem to believe that the long-run neutral rate is around the 3% mark, somewhat higher than was the case leading up to the pandemic. If 3% is the true neutral level for the federal funds rate, there may be perhaps 100 to 125 basis points in reductions before a non-restrictive, non-stimulative "neutral" federal funds target rate is reached. However, Fed Chair Powell recently noted that the "long-run" neutral rate is likely different than the "real-time" neutral rate for policy.

The Fed maintains that changes in monetary policy will depend on the incoming data, and that they are prepared to take steps as needed if labor markets or the broad economy stumble. From the statement: "The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals."

Economic conditions leading up to the meeting It is reasonable for the Fed to have moved away from excess restriction once economic conditions became more balanced last year. While there has been some considerable turbulence over the last month or two, most economic fundamentals are still fair despite the negative first-quarter GDP print.

To see though or around the distortion imports created in the first-quarter GDP reading, Mr. Powell noted that the Fed is guided by PDFP, or "private domestic final purchases", which eliminates some of the noise in the GDP data. PDFP ran at a 3% pace in the first quarter, little changed from the previous period or over the last year for that matter.

The March SEP already showed that members expect GDP growth to slow this year, managing only a 1.7% clip by the fourth quarter, and that estimation was pre-tariff announcement. Although starting from a hole in the first quarter, the current running estimate of GDP growth for the second quarter was 2.2% through the week ending May 6, so the effect of the surge in advance importing on GDP already seems to have passed. That said, the current estimate is only comprised of a small group of April data, with more to come for the first month of the second quarter, much less May and June's contribution.

It's also true that inflation continues to run at a level still a bit above the Fed's 2% core PCE target, but after a firming period late last year and into this one, it appeared as though progress was again being made on price pressures. At least through March, core PCE has settled back to a 2.6% annual rate, stepping a little closer to the Fed's 2% goal. In fact, March's 0.0% monthly change in core PCE was the first time the Fed's preferred measure of costs was flat since January 2018.

With still-too-high inflation flattening out at best, the Fed has become more aware of the changing conditions in labor markets. The good news on that front is that while hiring has slowed of late, the unemployment rate has run between 4% and 4.2% for many months now, about as "full" as employment can be expected to be. Wage gains have been solid at a level above the inflation rate, so "real" incomes are growing. This should provide at least some support for the economy at a time when uncertainty and unhappiness among consumers and businesses is elevated.

Also unchanged for a second time was the characterization of labor conditions. The meeting-closing statement again noted "The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid." while pointing out that the Fed remains "attentive to the risks to both sides of its dual mandate." While hiring has cooled, new job creation in April was 177,000 and has averaged 155,000 per month over the last three months, a solid enough pace. Mr. Powell's prepared remarks said that "he unemployment rate remains low, and the labor market is at or near maximum employment."

Overall, and despite elevated uncertainty, the Fed again stated that "...recent indicators suggest that economic activity has continued to expand at a solid pace."

Odds of Fed rate decreases

Today continued a period of "pause" for the Fed. At present it is not clear how long this pause will be, but there are currently low odds that the Fed will lower rates at its June meeting. Odds of a quarter-point reduction in the federal funds rate don't actually surpass the 50% mark until July, according to the CME FedWatch tool.

With the uncertainty of a new administration's policies yet to be fully described or realized, and the usual ebb and flow of the economy, holding rates steady is likely the proper stance for monetary policy. President Trump has promised significant tariffs on trading partners and significant changes to immigration policies, but how these changes intersect with the economy and affect growth and inflation can't be known until these changes are fully in place. Until then, it remains a bit of "wait and see" for the Fed.

The March 2025 update of the Summary of Economic Projections (SEP) revealed that Fed members expected to be lowering rates this year, but perhaps just a little, with up to two quarter-point decreases in the federal funds rate projected to come by year end. This forecast suggested that the federal funds rate would be at a median 3.9% at the cusp of 2026, only about a half-point lower than present levels..

Because of greater uncertainty, Mr. Powell's prepared remarks noted that "[The Fed] may find ourselves in the challenging scenario in which our dual-mandate goals are in tension. If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close. For the time being, we are well positioned to wait for greater clarity before considering any adjustments to our policy stance."

While it's both hopeful and encouraging for potential borrowers that rates will likely be lower at some point this year, it's also important to temper that enthusiasm. The reality is that even a 4.25% median federal funds rate would only leave it at about where it was in November-December 2022... and this would still be as high as this rate was back in late 2007. As such, this key short-term rate has moved only from about 23-year highs back down to the equivalent of perhaps 17 or 18 year highs. The cost of money will be cheaper, but still by no means cheap.

Perhaps more important for mortgage shoppers to remember is that the Fed does not directly control where mortgage rates go with its normal policy tools. In fact, mortgage rates have rose considerably after the Fed began trimming rates last September. With regard to this, Mr. Powell in January said that "longer rates have gone up, not because of expectations - not principally because of expectations about our policy or about inflation; it’s more a term premium story." The Federal Reserve Bank of New York describes it as such: "The term premium is defined as the compensation that investors require for bearing the risk that interest rates may change over the life of the bond." In essence, investors are asking for better compensation to buy up longer-term debt since the future to them seems highly unsettled.

Just prior to this meeting, futures markets reckoned that there was only slightly more than a 30% chance that another cut of at least a quarter percentage point would come in June. After the meeting closed, this was little changed, with more than 76% of futures-market contracts expecting no change to come. We'll see now these expectations evolve in coming weeks and reference them as needed in our weekly MarketTrends newsletter.

The next Fed meeting comes in mid-June (17th & 18th). There will be a fresh update to Fed members Summary of Economic Projections, and we'll get a much clearer look at how trade and other administration policy changes have changed the outlook of FOMC members at that point.

Fed's "balance sheet" trends

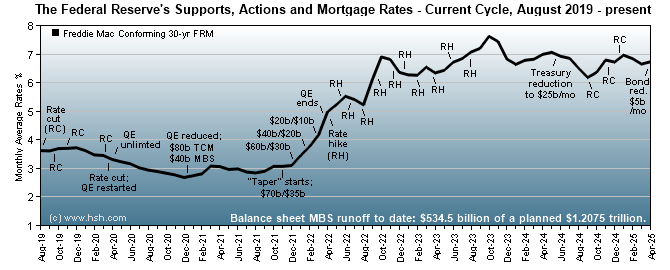

In addition to raising rates, the Fed is continuing the process of "significantly" reducing its balance sheet and is now trying to retire $35 billion of MBS and $25 billion of Treasury debt from its investment portfolio each month. Starting in April, it will slow the rate of runoff for Treasuries to just $5 billion per month, so the process of Quantitative Tightening (QT) will slow considerably but occur over a longer period of time.

Achieving desired levels of portfolio runoff of mortgage holdings may eventually see the Fed need to conduct outright sales of MBS. With mortgage rates high, home sales slow and refinancing at a virtual standstill, the current rate of MBS runoff was and is highly likely to run below desired levels, as has been the case since the runoff program began 36 months ago.

The general process of balance-sheet reduction is accomplished by no longer using the proceeds of inbound interest and principal payments from the Fed's existing holdings to buy more bonds. This happens when payments are made or mortgages are refinanced. With refinancing activity muted, reductions in holdings are only happening as borrowers whose mortgages make up those MBS pay down their loan balances, which any homeowner knows is a slow process.

As of May 1, the Fed held $2.173 trillion in mortgage paper, down from $2.707 trillion when the QT program began in June 2022, so the reduction in MBS holdings isn't happening at the pace the Fed had hoped. By design, some $1.207 trillion should have been trimmed from Fed MBS holdings by the end of this month, but the decline has only been about $534.5 billion to date, far less than half of what the Fed was hoping to achieve. While MBS holdings will decline faster as mortgage rates fall and refinancing activity picks up, the Fed's present holdings of MBS are only at a level they thought would have occurred back in October/November 2023, so the process of reducing MBS holdings is well more than a year behind schedule.

It's not known (the Fed may not even know at this point) what size the balance sheet will need to be in the Fed's "ample reserves" monetary regime. If we assume that the central bank was comfortable with the size of the balance sheet pre-pandemic, this would be total holdings of about $4 trillion, so they would need to achieve about $5 trillion in reduction over some period of time.

As of April 30, the total Fed balance sheet was about $6.71 trillion, so despite reducing its holdings by about $2.26 trillion, there remains a ways to go if the goal is to return to a pre-pandemic level. The Fed has slowed its runoff of Treasury holdings to $5 billion per month, while MBS reductions remain at $35 billion. Redemptions of mortgages have not yet hit this cap since the start of the runoff program, but when they do, any redemptions in excess of $35b will be used to buy up more Treasury bonds rather than more MBS.

What is the federal funds rate?

The federal funds rate is an intrabank, overnight lending rate. The Federal Reserve increases or decreases this so-called "target rate" when it wants to cool or spur economic growth.

The last change to this rate by the Federal Reserve came on December 18, 2024. That was the third decrease in the funds rate since March 2020, when the Fed began an aggressive series of cuts to support the economy as the pandemic upended everything. The current 4.25% to 4.5% range is the lowest it has been since December 2022.

By the Fed's recent thinking, the long-run "neutral" rate for the federal funds is perhaps 3 percent or so, a level well below what was long considered to be a "normal" level. The Fed raised the federal funds rate well above this normal level in order to temper inflation pressures that rose to more than 40-year highs in 2022. While the Fed lowered interest rates fairly rapidly at the start of this new monetary policy cycle, short-term rates may be slow from here to be moved closer to the Fed's "long-run" 3% rate. As of March 2025, the central bank's own forecast doesn't expect for it to return there until after 2027 at the very earliest.

The Fed may establish a range for the federal funds rate or express a single value for this key monetary policy tool.

Related content: Federal Funds Rate - Current and Historical Data, Graph and Table of Values

How does the Federal Reserve affect mortgage rates?

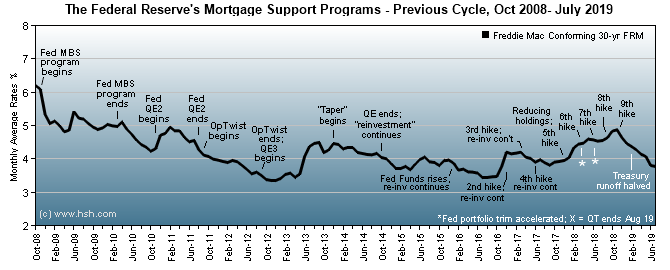

Historically, the Federal Reserve has only had an indirect impact on most mortgage rates, especially fixed-rate mortgages. That changed back in 2008, when the central bank began directly buying Mortgage-Backed Securities (MBS) and financing bonds offered by Fannie Mae and Freddie Mac. This "liquefied" mortgage markets, giving investors a ready place to sell their holdings as needed, helping to drive down mortgage rates.

After the program of MBS and debt accumulation by the Fed ended, they were still "recycling" inbound proceeds from maturing and refinanced mortgages to purchase replacement bonds for a number of years. This kept their holdings level and provided a steady presence in the mortgage market, which helped to keep mortgage rates steady and markets liquid for years.

This recycling of inbound funds lasted until June 2017, when the Fed announced that the process of reducing its so-called "balance sheet" (holdings of Treasuries and MBS) would start in October 2017. In a gradual process, the Fed in steps reduced the amount of reinvestment it was making until it eventually was actively retiring sizable pieces of its holdings. When the program was announced, the Fed held about $2.46 trillion in Treasuries and about $1.78 trillion in mortgage-related debt. It had been reducing holdings at a set amount and was on a long-run pace of "autopilot" reductions through December 2018.

By 2019, the Fed decided to begin winding down its balance-sheet-reduction program with a termination date of October. With signs of some financial distress showing in financial markets due to a lack of liquidity, the Fed decided to terminate its reduction program two months early.

For that run, the total amount of runoff ended up being fairly small, and the Fed was still left with huge investment holdings. At the time, the Fed's balance sheet was comprised of about $2.08 trillion in Treasuries and about $1.52 trillion in mortgage-related debt. Although no longer reducing the size of its portfolio, the Fed began to manipulate its mix of holdings, using inbound proceeds from maturing investments to purchase a range of Treasury securities that roughly mimicked the overall balance of holdings by investors in the public markets.

At the same time, up to $20 billion each month of proceeds from maturing mortgage holdings (mostly from early prepayments due to refinancing) were also to be invested in Treasuries; any redemption over that amount was be used to purchase more agency-backed MBS. Ultimately, the Fed prefers to have a balance sheet comprised solely of Treasuries obligations, and changing the mix of holdings from mortgages to Treasuries as mortgages were repaid was expected to take many years. But these well-considered plans didn't last.

Then came the pandemic. In response to turbulent market conditions from the COVID-19 pandemic, the Fed re-started QE-style purchases of Mortgage-Backed Securities in March 2020, so not only did the slow process of converting MBS holdings to Treasuries come to a halt, the Fed was again actively buying up new MBS, growing their mortgage holdings. Through October 2021, MBS purchases were running at a rate of $40 billion per month, and any inbound proceeds from principal repayments existing holdings were being reinvested in additional purchases. As economic conditions settled, MBS bond buys were trimmed to $30 billion per month starting in December 2021 and then to $20 billion per month in January 2022 and it was expected that a similar pace of reduction going forward would occur.

Since the Fed's restart of its MBS purchasing program in March 2020, it had by mid-April 2022 added more than $1.37 trillion of them to its balance sheet. Total holdings of MBS topped out at about $2.740 trillion dollars, and the Fed's mortgage holdings had doubled since March 2020.

The Fed has since concluded its bond-buying program. The start of a "runoff" process to reduce holdings was announced at the close of the May 2022 meeting and began in June 2022. Reductions of $17.5 billion in MBS in the first three months of the program increased to $35 billion per month in September 2022, and desired reductions in holdings remain at this pace today, but market redemptions remain well short of this goal.

What is the effect of the Fed's actions on mortgage rates?

Mortgage interest rates began cycling higher well in advance of the first increase in short-term interest rates. This is not uncommon; inflation running higher than desired in turn lifted expectations that the Fed would lift short-term rates, which in turn has lifted the longer-term rates that influence fixed-rate mortgages. Persistent inflation reinforced that cycle.

The reverse of the above is also true. Mortgage rates decreased considerably from peak levels, as an improved outlook for price pressures, loosening labor market conditions and cooling economic growth all suggest that the Fed's cycle of increases has done its job, and that lower short-term rates will be coming. Even though this is likely the case, it doesn't mean that this process will happen quickly or that mortgage rates will decline at a steady pace or by very much.

Also important for this new rate-cutting cycle is that the Fed is no longer directly supporting the mortgage market by purchasing Mortgage-Backed Securities (which helps to keep that market liquid). This means that a reliable buyer of these instruments -- and one that did not care about the level of return on its investment -- has left the market.

This leaves only private investors to buy up new MBS, and these folks care very much about making profits on their holdings. Add in a range of risks to the economy -- including such things as the potential for softening home prices and this may make them more wary of purchasing MBS, even at relatively high yields. With the Fed also no longer purchasing Treasury bonds to help keep longer-term interest rates low, the yields that strongly influence fixed mortgage rates also rose, and may also be slower to decline than they have been in recent years.

What the Fed has to say about the future - how quickly or slowly it intends to raise rates or lower rates this year and beyond - will also determine if mortgage rates will rise or fall, and by how much. The path for future changes in the federal funds rate is always uncertain, but the current expectation is that rates will generally be on a downward path over the next few years.

Does a change in the federal funds influence other loan rates?

Although it is an important indicator, the federal funds rate is an interest rate for a very short-term (overnight) loan between banks. This rate does have some influence over a bank's so-called cost of funds, and changes in this cost of funds can translate into higher (or lower) interest rates on both deposits and loans. The effect is most clearly seen in the prices of shorter-term loans, including auto, personal loans and even the initial interest rate on some Adjustable Rate Mortgages (ARMs).

However, a change in the overnight rate generally has little to do with long-term mortgage rates (30-year, 15-year, etc.), which are influenced by other factors. These notably include economic growth and inflation, but also include the whims of investors, too. For more on how mortgage rates are set by the market, see "What moves mortgage rates? (The Basics)."

Does the federal funds rate affect mortgage rates?

Whenever the Fed makes a change to policy, we are asked the question "Does the federal funds rate affect mortgage rates?"

Just to be clear, the short answer is "no," as you can see in the linked chart.

That said, the federal funds rate is raised or lowered by the Fed in response to changing economic conditions, and long-term fixed mortgage rates do of course respond to those conditions, and often well in advance of any change in the funds rate. For example, even though the Fed was still holding the funds rate steady at near zero until March 2022, fixed mortgage rates rose by better than three quarters of a percentage point in the months that preceded the March 17 increase. Rates increased amid growing economic strength and a increasing concern about broadening inflation pressures.

A more recent example also shows the converse effect. The Fed last raised rates in July 2023 held them steady through August 2024. Over that time, mortgage rates rose and then declined by well more than a full percentage point. All this change in mortgage rates happened while the Fed stood idly by.

What does the federal funds rate directly affect?

When the funds rate does move, it does directly affect certain other financial products. The prime rate tends to move in lock step with the federal funds rate and so affects the rates on certain products like Home Equity Lines of Credit (HELOCs), residential construction loans, some credit cards and things like business loans. All will generally see fairly immediate changes in their offered interest rates, usually of the same size as the change in the prime rate or pretty close to it. For consumers or businesses with outstanding lines of credit or credit cards, the change generally will occur over one to three billing cycles.

The prime rate usually increases or decreases within a day or two of a change in the federal funds rate.

Related content: Fed Funds vs. Prime Rate and Mortgage Rates

After a change to the federal funds rate, how soon will other interest rates rise or fall?

Changes to the fed funds rate can take a long time to work their way fully throughout the economy, with the effects of a change not completely realized for six months or even longer.

Often more important than any single change to the funds rate is how the Federal Reserve characterizes its expectations for the economy and future Fed policy. If the Fed says (or if the market believes) that the Fed will be aggressively lifting rates in the near future, market interest rates will rise more quickly; conversely, if they indicate that a long, flat trajectory for rates is in the offing, mortgage and other loan rates will only rise gradually, if at all. For updates and details about the economy and changes to mortgage rates, read or subscribe to HSH's MarketTrends newsletter.

Can a higher federal funds rate actually cause lower mortgage rates?

Yes. At some point in the cycle, the Federal Reserve will have lifted interest rates to a point where inflation and the economy will be expected to cool. We saw this as recently as 2023; after the eleventh increase in the federal funds rate in over a little more than a 16-month period, economic growth slowed, labor markets cooled, inflation pressures waned and mortgage rates retreated from multi-decade highs, falling by more than a percentage point and a half from peak levels by the time the Fed cut rates in September 2024.

The most recent episode of declining mortgage rates during the end of 2023 and start of 2024 also demonstrates this point.

As the market starts to anticipate this economic slowing, long-term interest rates may actually start to fall even though the Fed may still be raising short-term rates or holding them steady. Long-term rates fall in anticipation of the beginnings of a cycle of reductions in the fed funds rate, and the cycle comes full circle. For more information on this, Fed policy and how it affects mortgage rates, see our analysis of Federal Reserve Policy and Mortgage Rate Cycles.